Contents:

If that sounds appealing to you, take a look at our in-depth review of Interactive Brokers. Pepperstone provides a top-notch, beginner-friendly trading program at no cost. The program is arranged into distinct topics, making it accessible and easy to understand for those new to trading. The broker also offers advanced courses for more experienced traders seeking to enhance their skills and knowledge. According to our extensive research and analysis, Pepperstone has established itself as the premier Trading Broker in the industry.

The Questrade dividend reinvestment plan , which automatically reinvests all my dividends, is easy to set up and saves me a lot of time. I’ve personally been using Questrade for almost a decade now, and have had nothing but great experiences with the company. The reports are easy to understand, and ETF purchases are free. All Canadian stocks and ETFs are completely commission-free to trade on Wealthsimple Trade. I estimate that between 50-70% of Canadians fall into that description.

ABOUT THE REVIEWER

The reason for the problem was that Forex.com can’t send money to some MasterCard and Visa credit cards. Instead of credit cards, we had to withdraw via bank transfer, but before doing so, customer service had to add and approve our bank account. It would be great to know in advance which cards are accepted for withdrawal and which are not. A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

One of my favourite features is that it has 105 completely commission-free ETFs to buy and sell. This includes very popular all-in-one ETFs such as iShares XGRO. The platform is well thought out and intuitive for newer users. It also provides advanced research tools for those who need them. Trading platforms are by far the cheapest way to invest in Canada, edging out both traditional banks and robo-advisors. We tested it and collected the options and costs in How to withdraw money on Forex.com.

Best Forex Demo Accounts In Canada 2023: Top 10 Picks & Reviews – Biz Report

Best Forex Demo Accounts In Canada 2023: Top 10 Picks & Reviews.

Posted: Wed, 05 Apr 2023 10:22:00 GMT [source]

You then have platforms that offer really competitive fees but are somewhat limited in the asset class department. Questrade is one of the best trading platforms in Canada for building a self-directed portfolio of assets in a low-cost and burden-free environment. As soon as you head over to the provider’s website, you can see that it’s aimed at casual investors that are potentially new to the online trading scene. For example, stocks can be purchased from just $8.75 per trade. There are no commissions to pay when you invest in mutual funds and Qtrade offers 100 fee-free ETFs.

In order to uncover competitor information, we looked at our competitors’ websites, press releases, and third-party sites. The information collected relates to features, accounts, and pricing. It’s important to note that the general information within this guide is not specific to your personal situation. Some brokers requested that we not cover them in our content and those brokers have been excluded. To help you pick the best online broker for your needs, below we’ll compare some of the main online brokerages that operate in Canada.

FP Markets Has The Fastest Trade Execution Speeds

Alternatively, search for a broker on the IIROC’s ‘Dealers We Regulate’ page. When a broker does not hold a license with the IIROC, each local regulator has the authority to decide whether a broker can operate within that area. Professional or seasoned traders will also want to strongly consider Interactive Brokers due to its sophisticated offering and low costs of trading. Canadian forex brokers are generally very safe due to the requirement of being an IIROC member. Unlike traditional investing, which is more predictable and typically avoids the use of leverage, forex trading is a much higher-risk endeavour.

- FP Markets is a national leader in providing a diverse range of financial instruments to clients.

- The requirements are a minimum balance of $25,000 and at least $50 million traded on a monthly basis.

- On the other hand, the Amazing Trader is a charting algorithmic platform for FX, indices, cryptos and metals, adding to the diversity of platforms Eightcap offers.

The minimum deposit is $5000 USD however, for the Standard account. Sean A’Hearn is an experienced Content Writer with a background in finance, music journalism and tennis. He has a knack for words and making them fit in any context to educate, entertain and persuade. He’s worked as a freelance journalist, a trader at a Hedge Fund (both front-office and back-office) and as a PR director of an artist development company. Sean holds a Bachelor of Business, majoring in Economics and Finance , from RMIT University. In 2010, Sean obtained his US SEC Series 3 license to trade futures on the global stock markets from FINRA.

Forex Risk Disclaimer

Most of the best brokers Canada that we have discussed today allow you to trade on a native mobile app that is compatible with iOS and Android. You should now have all of the information required to find the best trading platform in Canada for your needs. If so, it’s now time to get the ball rolling by opening an account with the provider in question. There are several other trading fees that you might be exposed to at your chosen investment platform.

Some of the best trading platforms in Canada offer support for third-party platform MT4. This comes with several benefits – such as having access to advanced charting tools and technical indicators. Perhaps even more notable is the fact that MT4 allows you to install an automated trading robot. Once installed, the robot will trade on your behalf in a fully automated manner. For example, some trading platforms give you access to thousands of marketplaces but might be on the high side in terms of pricing.

Please be aware that this might heavily reduce the functionality and https://forex-reviews.org/earance of our site. Use the best strategy and carry out basic analysis to trade the market. Proceed to registration and trading once you’ve picked a suitable broker. Internationally brokers are also safe if the broker holds a license from a top-rated financial body. Canadians can be safe and enjoy full protection if they deal with IIROC-licensed brokers inside Canada.

Besides customer support, TMGM canadian forex review a unique feature called TMGM Academy. Through the TMGM Academy, you can learn about the ins and outs of forex trading. There are three stages available, Beginner Stage, Intermediate Stage, and Advanced Stage. This platform is only suitable for traders wishing to trade shares. Using this account/platform gives you access to TMGM’s full range of 12,000 shares across US, AU, UK, HK, CN and SG exchanges. He has 15 years of experience in the financial sector and forex in particular.

The IIROC permits Canadians to deal with licensed forex brokers outside Canada. The country is among the few developed nations in the world allowing this. The classic “buy low, sell high” trading strategy, swing or momentum trading involves entering and exiting the market based on momentum technical indicators. Next you need a funded account with an online broker that allows you to trade forex from Canada. You also need to develop a trading plan and strategy to increase your chances of success.

To make that even more appealing, the brokerage focuses on spread-only pricing – all traders, regardless of account types, will pay $0 in commission fees. A reputable broker should offer traders the chance to test the trading platform. The trader should experience the broker’s trading environment and basic features on the platform before investing their money. Some brokers offer lifetime access to this free account with reloadable virtual credits. The trader should avoid any broker who DOES NOT give the option of a free demo. EToro is a comprehensive yet simple-to-use app that has over 3,000 different assets that you can trade.

Competitive Spreads with Raw Account

Price action trading involves the use of less technical indicators and more recent price information. The trader looks at the price chart and places trades based on the current moves. Instead, they base the trading decisions on ongoing price movements, as the candlesticks show.

An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell. Even the best traders can lose money, but the key to long-term success lies in sticking to a trading plan that keeps your average losses low . Compare Canada authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm’s ForexBrokers.com Overall ranking. In Canada, any profits made from trading forex will not be subject to income tax, but to a capital gains tax.

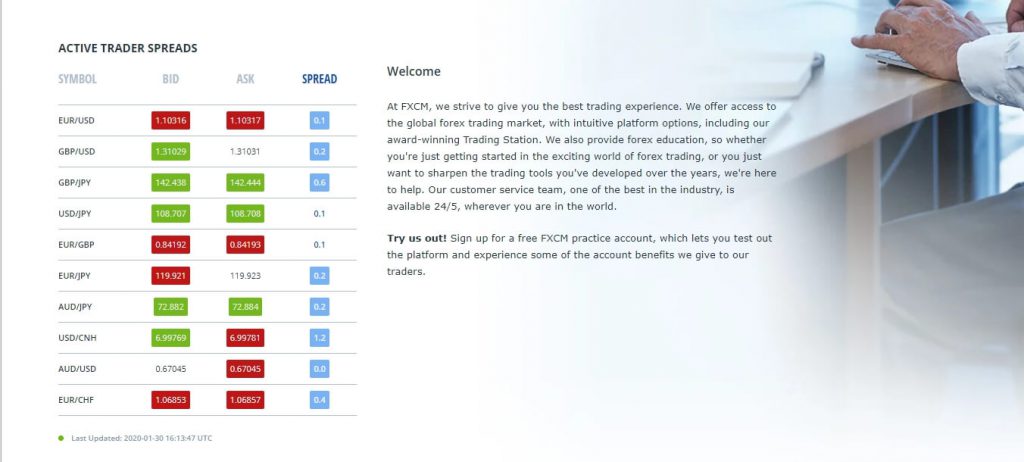

Remember, some brokers will have different spreads and different commission levels for different account types. Typically, Forex brokers in Canada will give better trading costs in the form of spreads and/or commissions for larger account types that require a higher minimum deposit. Also, some forms of execution, such as ECN execution can only be delivered with minimum account sizes. ECN execution is where the broker passes your trade directly to the underlying liquidity pool and does not trade against their clients. AvaTrade is one of the largest Forex / CFD brokers and well-known for offering their clients a choice of fixed or floating spreads.